Hey there, book lovers! If you’re anything like me, you know the transformative power of a good book. Whether it’s escaping into a magical world, calming your mind, or learning something new, books are our ultimate companions. Today, let’s talk about something that isn’t just fascinating but incredibly empowering: financial literacy and development.

Managing money, building wealth, and achieving financial freedom can feel intimidating, but the right books can make it approachable and even exciting! If you’re a beginner eager to learn how to take charge of your finances, this list is for you. Grab your notebook, a cup of coffee, and let’s explore the top 10 books on financial literacy and growth for beginners.

Table of Contents

10 Best Books for Beginners on Finance and Wealth Building

1. “Rich Dad Poor Dad” by Robert T. Kiyosaki

This classic has stood the test of time for a reason. Robert Kiyosaki shares lessons he learned from his two “dads”: his biological father (poor dad) and his friend’s father (rich dad). The book breaks down the differences in their mindsets and approaches to money. Kiyosaki introduces concepts like assets and liabilities in a simple, relatable way, making it easier for beginners to grasp the fundamentals of financial independence. He emphasizes the importance of investing in income-generating assets, starting small, and thinking long-term. It’s not just a book; it’s a mindset shift.

Why it’s a must-read: It’s perfect for understanding the basics of financial independence and the importance of investing in assets over liabilities.

2. “The Total Money Makeover Updated and Expanded: A Proven Plan for Financial Peace

Dave Ramsey’s no-nonsense approach to budgeting, debt elimination, and building wealth is life-changing. This book lays out practical steps for managing your money and achieving financial freedom. Ramsey introduces his famous “Baby Steps,” a step-by-step plan that has helped millions of people get out of debt and build a stable financial future. The book is packed with real-life success stories that prove anyone can take control of their money with discipline and determination.

Why it’s a must-read: It’s a straightforward, step-by-step guide that’s especially helpful if you’re struggling with debt.

3. “I Will Teach You to Be Rich” by Ramit Sethi

Ramit Sethi’s witty and conversational tone makes financial planning approachable and fun. This book covers budgeting, investing, and automating your finances so you can live your “rich life.” Sethi focuses on practical strategies, like optimizing credit cards, setting up high-interest savings accounts, and investing in low-cost index funds. His emphasis on guilt-free spending encourages readers to prioritize what truly brings them joy while cutting back on unnecessary expenses.

Why it’s a must-read: It’s packed with actionable advice for millennials and Gen Z looking to take control of their finances.

4. The Intelligent Investor Rev Ed. The Definitive Book on Value Investing

Known as the bible of investing, this book by Benjamin Graham introduces the concept of value investing and provides timeless advice on navigating the stock market. Graham teaches readers how to analyze stocks, minimize risks, and make informed investment decisions. While the book is dense, it’s a treasure trove of wisdom for anyone serious about building wealth through investing. Warren Buffett, one of the world’s most successful investors, often cites this book as a major influence.

Why it’s a must-read: While it’s a bit dense, the wisdom in this book is invaluable for anyone serious about investing.

5. “You Are a Badass at Making Money” by Jen Sincero

Jen Sincero’s book is perfect if you want to change your mindset around money. It’s part self-help, part financial advice, and 100% empowering. Sincero uses humor and personal anecdotes to break down complex financial concepts into relatable and digestible lessons. She focuses on overcoming limiting beliefs, building confidence, and attracting wealth by shifting your mindset and energy.

Why it’s a must-read: Sincero’s humor and relatable anecdotes make financial growth feel less daunting and more fun.

6. “Your Money or Your Life” by Vicki Robin and Joe Dominguez

This book challenges you to rethink your relationship with money and introduces the concept of financial independence. It’s all about aligning your spending with your values. Robin and Dominguez guide readers through a nine-step program designed to help you track your spending, reduce expenses, and create a life that aligns with your goals. The book emphasizes the importance of mindful spending and finding fulfillment beyond material possessions.

Why it’s a must-read: It’s a holistic guide to achieving financial freedom and finding fulfillment beyond material wealth.

7. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko

Ever wondered how millionaires really live? Spoiler alert: It’s not flashy cars and extravagant lifestyles. This book explores the habits and mindsets of self-made millionaires. Stanley and Danko use research and data to uncover the surprising traits of wealthy individuals. They highlight the importance of living below your means, avoiding debt, and consistently saving and investing over time.

Why it’s a must-read: It’s eye-opening and inspiring, showing that anyone can build wealth through discipline and smart financial choices.

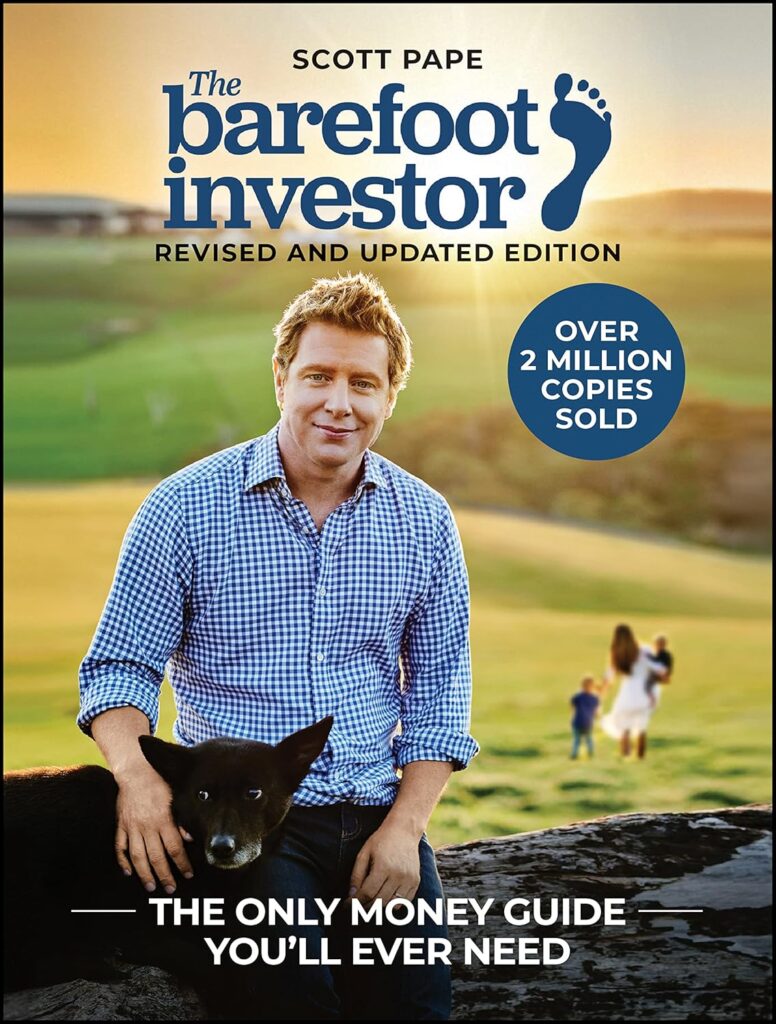

8. “The Barefoot Investor” by Scott Pape

Scott Pape’s practical advice is perfect for beginners who want to simplify their finances. The book is filled with step-by-step strategies for budgeting, saving, and investing. Pape’s “barefoot steps” include setting up buckets for your money, creating a financial safety net, and investing for long-term growth. His laid-back tone and real-life examples make financial planning feel approachable and achievable.

Why it’s a must-read: It’s beginner-friendly and offers a clear, actionable plan for financial success.

9. “Think and Grow Rich” by Napoleon Hill

This timeless classic isn’t just about money; it’s about cultivating a mindset of success. Napoleon Hill shares 13 principles for achieving wealth and personal fulfillment. Hill draws on the experiences of successful individuals like Andrew Carnegie and Henry Ford to illustrate the power of desire, faith, and persistence. The book encourages readers to define their goals and take consistent action toward achieving them.

Why it’s a must-read: It’s a motivational powerhouse that’s inspired countless entrepreneurs and wealth builders.

10. “The Psychology of Money” by Morgan Housel

Morgan Housel’s book explores the emotional and psychological aspects of money. It’s filled with stories and insights that help you make smarter financial decisions. Housel emphasizes that managing money isn’t just about knowledge—it’s about behavior. The book covers topics like risk, luck, and the importance of long-term thinking. It’s an engaging read that blends storytelling with practical lessons.

Why it’s a must-read: It’s an easy yet profound read that shifts how you think about wealth and happiness.

A Few Tips for Your Financial Literacy Journey

- Start Small: Don’t feel pressured to read everything at once. Pick one book that resonates with you and go from there.

- Take Notes: Jot down key takeaways and action steps as you read.

- Apply What You Learn: Knowledge is power, but only if you use it. Start implementing small changes in your financial habits.

- Find a Community: Join book clubs or online forums focused on financial literacy to share insights and stay motivated.

So, lovely bookworms, which of these financial gems will you dive into first? Do you have a personal favorite that’s not on the list? Let me know in the comments! Here’s to turning the page on a new chapter of financial growth and empowerment.